Springbrook seasonal tax training webinars for guidance on 1099 preparation.

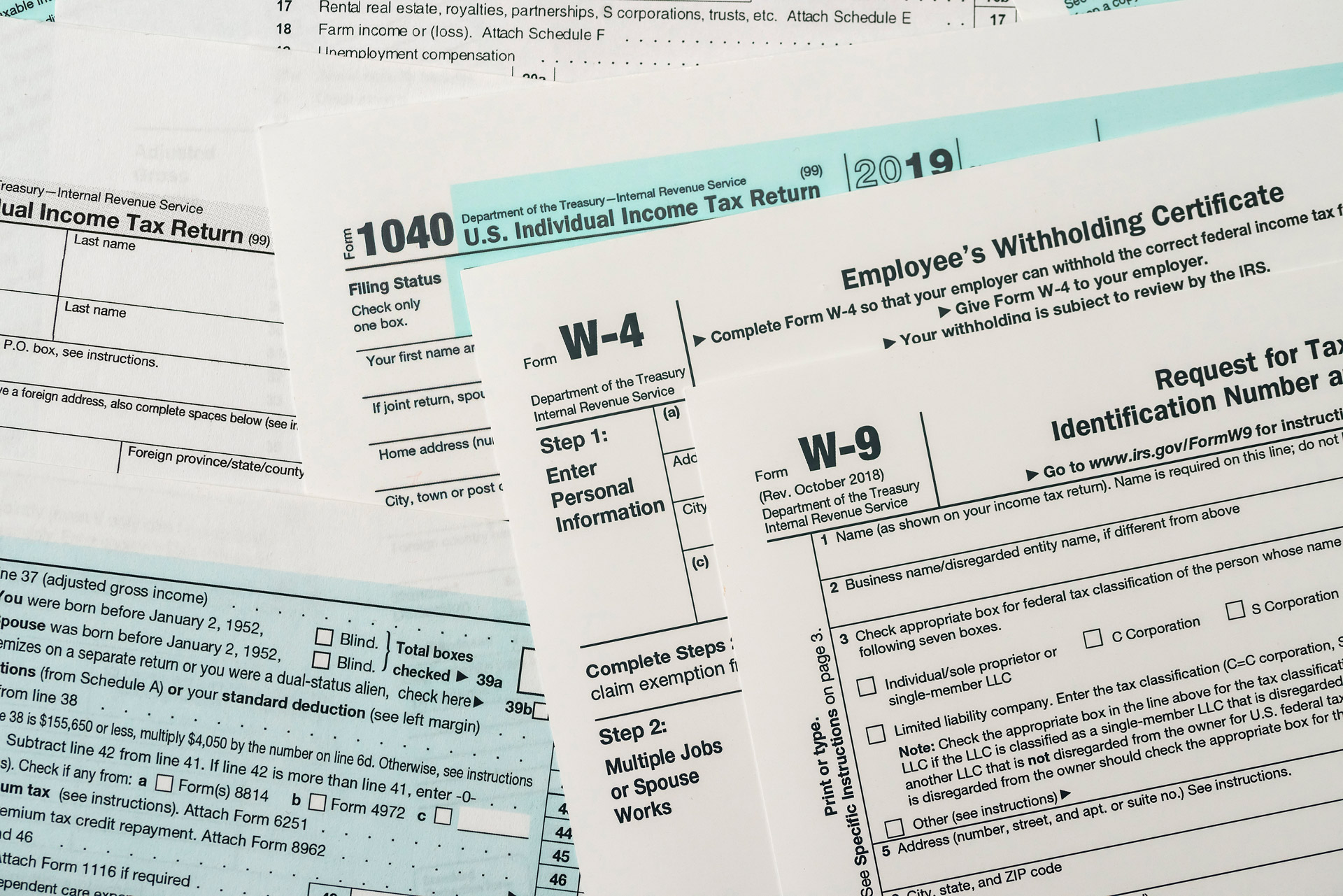

1099’s were originally created to provide support for business income claimed on business tax returns. With the advent of the Gig Economy, the changing nature of work, and even the definition of Employer, 1099’s are now adapting for the 2020 Tax Year.

Form 1099 will now have another significant variation: the 1099 MISC form will now be joined by the 1099 NEC form. The new form will now separate out payments made for the following purposes:

- Payments made for services, including parts and materials, performed by someone who is not your employee.

- Cash payments for fish. (This one probably does not apply to your government.)

- Payments to attorneys that are not related to settlements.

The 1099 NEC has a filing deadline of January 31, similar to the W-2 filing deadline. In general, the same rules apply to the 1099 NEC as the 1099 MISC. The threshold for payments is still $600. Reportable entities are sole proprietorships, partnerships, and LLC’s taxed as partnerships. There is some variation, so please check the instructions available at www.IRS.gov. The IRS has shifted certain boxes on form 1099-MISC to accommodate the new form 1099-NEC. Please read the guidance in the Form 1099 Instructions found here:

1099 MISC: https://www.irs.gov/forms-pubs/about-form-1099-misc

1099 NEC: https://www.irs.gov/forms-pubs/about-form-1099-nec

Springbrook Software has adapted to these changes as well, and you will still be able to produce the correct form 1099’s from your software. We do recommend buying your paper forms now so you can avoid empty shelves.

Finally, you can ensure your 1099 filing process is relatively error free if you make sure your vendors that will fall into the filing threshold provide you with up to date Forms W-9. Avoid the most common error with 1099’s – an incorrect Taxpayer Name!

Don’t wait until the last minute, the filing deadline is January 31st. Get started now for a smooth end of year process and keep your eyes out for our Year End webinar series